Funding success rates are below 1%, and less than 1% of startups receive venture capital funding. Further emphasizing the point, a pitch deck is vital. Your pitch deck is a major factor that's going to bring you the funds your startup requires to scale up. In this article, you'll find out what investors look for when it comes to pitch decks, plus actionable advice on how to maximize your chances of securing investment.

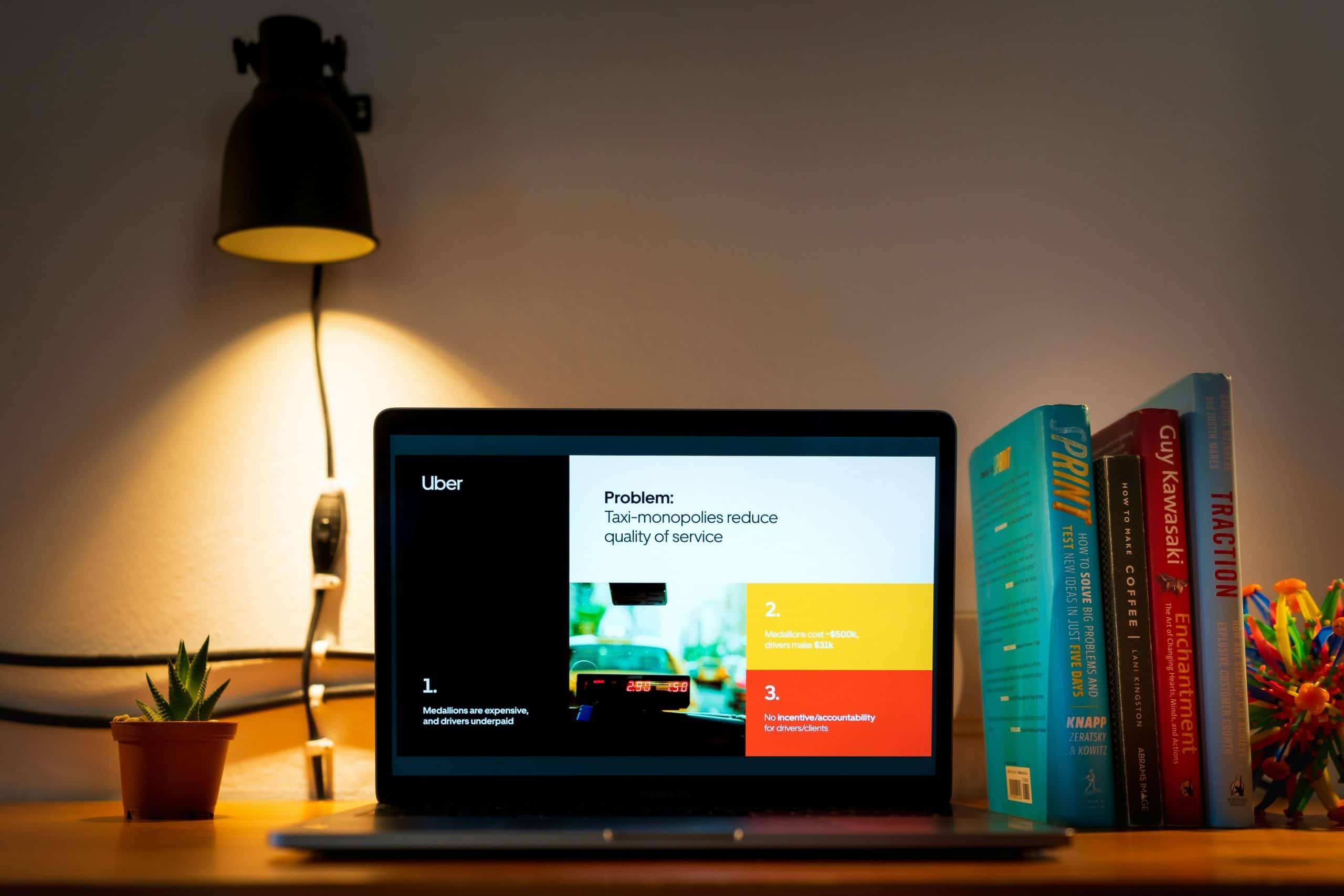

The Problem & Solution - A Seductive Pitch Deck Storytelling Explanation of the Problem

To capture attention, clearly define the market problem that your startup addresses. Use supporting data to illustrate the size of the market problem. For example, if you seek to solve a common problem people have with a certain product, you need to indicate how many people experience this problem and how much it costs them. The more tangible your statistics are, the more investors will see the need for what you offer.

Present Your Solution in the Pitch Deck

Your presentation should highlight how your startup solves this problem uniquely. Graphs or diagrams will help to explain it more clearly. Keep your language short. Explain how your solution is different from anything else out there. Did you develop a new technological advancement or a unique service? Communicate these points across effectively.

Value Proposition

Investors are looking to understand what value is unique in your product or service. This isn't just about solving a problem; it's about highlighting the distinct advantages that will make your offering so desirable to customers that it will be worth the investment. Clearly articulate how your solution makes customers' lives or businesses better.

Market Analysis - Show, Don't Tell

Market Research & Validation

Demonstrate in-depth market research to support your claim. Include market size, growth potential, and target audience information. Use statistics from recognized market research firms. This proves you know your market inside out and are ready for competition.

Competitive Landscape

Competitor analysis: Describe who your competitors are, their products or services, and how you differ. Maybe you offer superior service, have lower costs, or take a fresh approach. Include examples to help paint a picture of your competitive edge.

Go-to-Market Strategy Pitch Deck

Describe how you'll reach the target market. How will you get and retain customers? Is it through online marketing, partnerships, or direct sales? A clear go-to-market strategy shows that you have a plan to turn your idea into a successful business.

Business Model & Financials - Transparency is Key

Revenue Model & Projections

Explain your revenue model clearly and make some realistic financial projections. Investors would like to know how you will make money. Give examples of similar businesses that are financially successful to give them an idea of what could be the potential for your start-up.

Pitch Deck: Key Metrics & KPIs

Highlight significant KPIs. Describe why each KPI is important to the business-be it customer acquisition cost or monthly recurring revenue. These metrics will show the progress being made by your business and potential for growth to any investor.

Funding Request & Use of Funds

State unequivocally how much money you are looking for and what you'll be using it for. Categorize the budget into product development, marketing, and operations. Providing a timeline of when you will achieve your milestones helps reassure investors of your planning capabilities.

The Team - Experience Matters

Team Expertise & Experience

Highlight relevant experience within your team. Short bios on achievements and skills at an individual level will help. Investors need to be assured your team can execute the plan.

Advisory Board - If applicable

If you have an advisory board, mention it. Key advisors bring valued insights and connections that enhance credibility in your startup.

Commitment of Team

Demonstrate how dedicated your team is towards the success of the startup. Give them stories that will help to outline passion and commitment. A motivated team increases investor confidence.

Pitch Deck Call to Action & Next Steps - Leave Them with a Lasting Impression

Clear Call to Action

Close your pitch with a clear call to action. Be very specific about what you're looking for from the investors, whether it's a certain funding amount or the opportunity to partner.

Contact Information

Make sure your contact information is conspicuous. Investors should not have to struggle to know how to contact you.

Pitch Deck Appendix (Optional)

Include extra sheets, such as detailed financial statements or extra market research data, if it will help. This shows you are prepared and thorough.

Conclusion

The key to a winning pitch deck is condensing the key points. Focus on the strong narrative supported by data analytics and a clearly defined call to action. Entrepreneurs should take heed of this advice and work on creating pitch decks that will hopefully make all the difference in securing them the funding they need.